Lesson 3: How to Invest in Trading Successfully

Trading is a challenging yet rewarding journey, but statistics show that 85% of traders lose their money. Why does this happen? The answer lies in education, risk management, and emotional control. The foundation of successful trading is investing in yourself first—developing knowledge, discipline, and a well-structured strategy.

Defeats in trading are inevitable. However, success is defined not by how often you fall but by how quickly you recover. Like the mythical phoenix rising from its ashes, professional traders learn, adapt, and continue their journey with resilience.

Understanding Market Analysis

To succeed in the financial markets, traders must learn and apply different analytical approaches. The two primary methods are:

Technical Analysis

Technical analysis forms the basis of our study in the following chapters. The market moves in patterns that tend to repeat over time, and by identifying these patterns, traders can predict price movements. The key elements of technical analysis include:

Trend Lines

Support and Resistance Levels

Supply and Demand Zones

Chart Patterns and Indicators

While it may seem complex at first, practice and persistence will refine your ability to analyze charts effectively.

Fundamental Analysis

Fundamental analysis is equally important, focusing on external factors such as political events, economic reports, and global news that impact the financial markets. Before opening a trade, it is crucial to check the economic calendar for scheduled news releases.

To stay updated with economic events, you can use reliable Forex calendars to anticipate market movements and avoid unexpected volatility.

Types of Trading Strategies

Traders can operate in different ways based on their personality and risk tolerance. Below are two of the most popular trading styles:

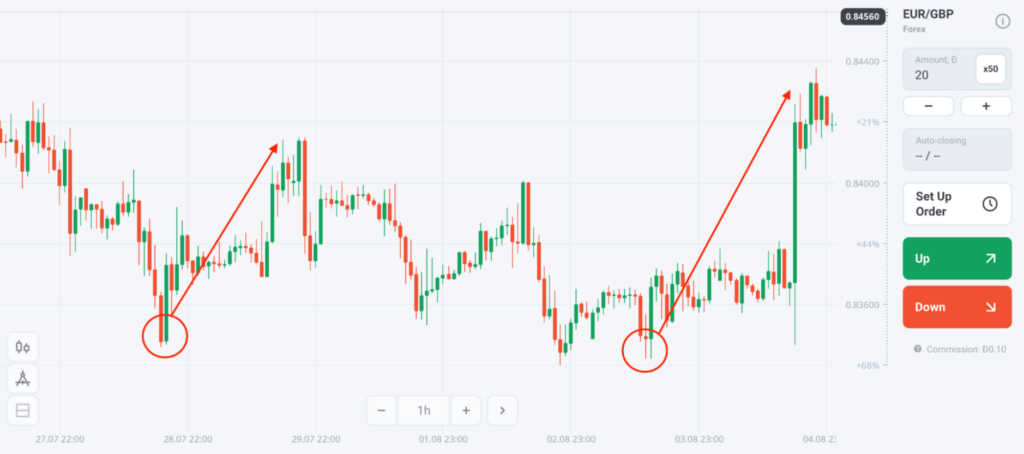

Swing Trading

Swing trading focuses on capturing long-term market trends. Traders enter positions and hold them from a few days to several weeks, waiting for significant price movements. Swing traders must calculate their position sizes carefully to manage risk effectively. Additionally, using a Stop Loss is crucial to protect against unexpected reversals.

Scalping and Day Trading

If the idea of holding positions for long periods makes you uneasy, scalping and day trading may be a better fit. This trading style involves opening and closing trades within minutes or hours, taking advantage of short-term price movements.

A scalper trader focuses on quick decisions and high-frequency trades, requiring a well-defined plan. Without a solid strategy, the risk of failure increases significantly.

Long vs. Short Positions

In online trading, traders can profit from both rising and falling markets:

Long Position: Clicking the “Buy” button means you anticipate the price to rise.

Short Position: Clicking the “Sell” button means you expect the price to decline.

Important: Clicking “Sell” does not close your position. To exit a trade, you must manually select “Close Position.”

Choosing the Right Trading Platform

The right tools are essential for efficient trading. Below are two highly recommended platforms:

MetaTrader 4/5: Industry-standard platforms for executing trades with ease.

TradingView: A powerful charting tool that provides in-depth technical analysis features.

By selecting the right trading style, refining your analysis skills, and using the appropriate platforms, you can increase your chances of success in the Forex market. In the next chapter, we will explore PIPS and how to determine your ideal trade size.

Start Trading

Start trading now with FintekMarkets and join thousands of traders who have already chosen this successful path.